Quick Overview

Pros & Cons

✅ Pros

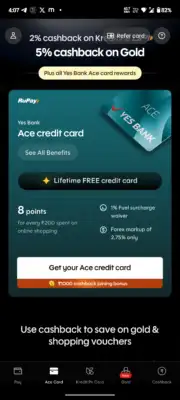

- ✓ Lifetime Free - Zero joining fee, zero annual fee, no hidden charges

- ✓ 2% Unlimited Cashback on UPI - One of the highest UPI cashback rates in India

- ✓ ₹1,000 Joining Bonus - Generous welcome bonus on activation

- ✓ 3% Milestone Cashback on ₹25,000+ monthly UPI spends

- ✓ 25% cashback on international spends (limited period)

- ✓ 8 reward points per ₹200 on online shopping (4% reward rate)

- ✓ Fuel surcharge waiver of 1%

- ✓ No reward point cap on UPI transactions

❌ Cons

- ✗ Existing YES Bank credit card holders cannot apply

- ✗ Only salaried individuals being approved currently

- ✗ RuPay network may have limited international acceptance

- ✗ No airport lounge access

🎯 Best For

About This Card

Hello folks, I hope you are saving a lot of money with our latest Credit card offers, Bill Payments Discounts, Refer and Earn offers and Free recharge tricks. We are back with one more Rewarding credit card from Yes Bank and I like this card for it’s UPI Benefits.

The YES Bank ACE Credit Card (formerly known as the YES Prosperity Rewards Plus Credit Card) is an entry-level rewards credit card designed to maximize your everyday spending. Whether you’re shopping online, dining out, or paying bills, this card helps you earn valuable reward points while enjoying exclusive lifestyle benefits.

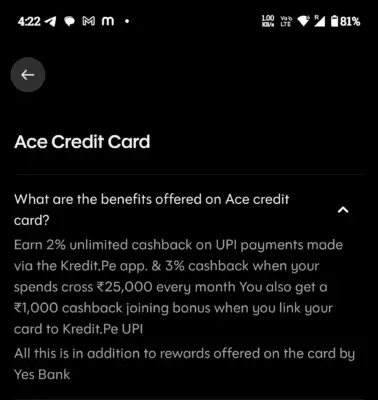

The USP of this card is 2% Cashback on all UPI Transaction using Kredit.pe app. There is no limit on 2% Cashback . You will earn 8 YES Rewardz Points per ₹200 spent online shopping and 4 points on offline spent on offline shopping. This is a good card if you are looking for a Cashback credit cards.

You will get 3% Cashback when you sepnd ₹25,000 in a month plus Most important ₹1000 as Joining bonus when you link onKredit.pe UPI app. This means total of 5% Cashback each month. Similar to Kiwi Credit card which also offers 3% Cashback on UPI and Supermoney Card

It’s a Lifetime Free Credit Card with amazing UPI Cashback rewards which is upto 3%

Where You Can redeem the cashback

- Digital Gold Purchase

- Mobile recharges

- Bill payments

- Online Shopping Vouchers

Is the Cashback 100% Redeemable ?

Simple Answer NO, We want be honest with you, We recently find out, You can use upto 5% Cashback on their different products like Bill Payments, Recharge, Digital Gold and Vouchers, You can use upto 60% on some gift cards but not all.

How To Apply For Kredit.pe Yes Ace Credit Card

1. First of all Click on below link to Download Kredit.pe app from app store/ play store.

2. Now once you download the app. You can simply use your adhar linked mobile number to signup.

3. You will see, Offer for Kredit.pe Ace credit card with Lifetime Free Offer.

4. Now Click on Get Your Ace Credit Card.

5. Next step will ask you to put Basic details, Personal / Employement Details & EKYC Details

6. Once all the details are filled, your eligibility is checked.

7. Based on the eligibility you will get a credit limit assigned to you.

8. Once the card is approved. You will get ₹1000 Cashback on Kredit.pe account.

9. Bonus Tip : You can refer friends on Kredit.pe Credit card and earn ₹1500 per referral plus an Airpods 4 for free.

How To Get 3% Cashback on UPI Payments with Kredit.pe card

Kredit.pe will offer base cashback on 2% Cashback on UPI Payments with Kredit.pe app and additional 1% when you pay ₹25,000 payments that makes total cashback of 3%

Kredit.pe Ace Credit Card Refer & Earn

You can now Refer friends on Kredit.pe Ace card, You will get ₹1500 referral cashback for each friend who joins and gets a new card and claim joining bonus. You will get extra ₹2500 when you refer 5 friends too.

Join Our Community Channels

Save Upto Rs.10,000 Per month with exclusive offers and deals. Get instant alerts!

1. First of all click on Refer chip.

2. Now copy your referral link.

3. Share the link with friends

4. Ask them to complete onboarding process.

Eligibility Criteria

Age Requirements:

- Minimum: 21 years

- Maximum: 60 years

Income Requirements:

For Salaried Individuals:

- Minimum net monthly salary: ₹25,000

For Self-Employed Individuals:

- Minimum annual ITR: ₹7.5 lakhs or above

Key Features

Unlimited 2% UPI Cashback

Earn 2% cashback on every UPI transaction made through Kredit.Pe app with no upper limit or monthly cap. Perfect for groceries, bill payments, mobile recharges, and everyday spends.

3% Milestone Cashback

Additional 3% cashback when your monthly UPI spends exceed ₹25,000 via Kredit.Pe UPI. Stack this with 2% base cashback for total 5% effective returns on higher spends.

₹1,000 Welcome Bonus

Get ₹1,000 cashback credited to your Kredit.Pe account immediately upon card activation. No spending requirement - just activate and earn.

YES Bank Reward Points

Earn YES Bank reward points separately on all card transactions: 8 RP per ₹200 online, 4 RP per ₹200 offline, 2 RP per ₹200 on utilities. Maximum 5,000 points per statement cycle.

Premium Brand Discounts

Redeem Kredit.Pe cashback for instant discounts: 6% off on Amazon/Flipkart, 12% off on Swiggy/Zomato, 24% off on Domino's/PVR, 60% off on OTT platforms, 100% off on Swiggy One.

25% International Spend Cashback

Limited period offer till 31st December 2025: Get 25% cashback on all international transactions. Maximum ₹1,500 per transaction, ₹15,000 total cap.

Purchase Protection Insurance

Insurance coverage up to ₹50,000 for accidental damage on mobile phones and electronics purchased online. Valid for 6 months from purchase date.

Fuel Surcharge Waiver

Get 1% fuel surcharge waiver on transactions between ₹400 to ₹5,000 at petrol pumps across India. Maximum waiver of ₹100 per statement cycle.

Digital Gold & FD Options

Buy digital gold at 7% discount using Kredit.Pe cashback. Upcoming features include 9% FD investment option and expanded cashback usage options.

Bill Payment Savings

Save ₹10 on every utility bill payment (electricity, water, gas, mobile) made through Kredit.Pe app. First bill gets ₹10 credited to bank account.

Contactless Payments

RuPay Platinum card with NFC technology for fast, secure, and contactless payments at retail stores and online merchants supporting RuPay.

EMI Conversion Facility

Convert purchases above ₹2,500 into easy EMIs. Post-purchase EMI conversion available. Interest rates from 12% to 15% per annum with tenure from 3 to 24 months.

Credit Shield & Lost Card Protection

Credit Shield cover of ₹1 lakh and Lost Card Liability protection of ₹1.3 lakhs for financial security in case of emergencies.

Foreign Currency Markup

Preferential foreign currency markup rate of 2.75% on international transactions (lower than standard 3.5%). Combine with 25% cashback offer for maximum savings.

Refer & Earn Program

Earn ₹1,250 when your friend successfully gets a YES Bank credit card through your referral. Plus earn 20% commission when your friends refer others.

Reward Program

Dual Rewards System Rewards

Eligibility Criteria

📄 Required Documents

- 📄 PAN Card (Mandatory)

- 📄 Aadhaar Card (Identity & Address Proof)

- 📄 Passport (Alternative ID/Address Proof)

- 📄 Driving License (Alternative ID/Address Proof)

- 📄 Voter ID Card (Alternative ID/Address Proof)

- 📄 Salary Slips - Last 2-3 months (For Salaried)

- 📄 Bank Statements - Last 3-6 months

- 📄 ITR - Last 1 year (For Self-Employed)

- 📄 Photograph - Recent passport size

- 📄 Form 16 or Salary Certificate (Additional income proof)

Frequently Asked Questions

Ready to Apply for Kredit.Pe Yes Ace Credit Card – Get ₹1000 Cashback as Joining Bonus + Unlimited 3% Cashback on UPI?

Join thousands of satisfied customers and start earning rewards today. Apply online in just 5 minutes!

Apply Now - Get Instant Approval ⚡Trending Credit Cards

IDFC FIRST Hello Cashback Credit Card

Comments